The global digital finance industry is watching closely as the Philippines rolls out new Filipino e-wallet regulations in 2025, set by the Bangko Sentral ng Pilipinas (BSP). Designed to strengthen security, enhance transparency, and streamline payment processes, these rules are reshaping how e-wallet providers, iGaming platforms, and consumers interact in an increasingly cashless economy. Beyond the local market, the changes carry global significance—affecting cross-border transactions, fintech innovation, and regulatory standards in the Asia-Pacific region.

What is BSP?

The Bangko Sentral ng Pilipinas (BSP) is the central monetary authority in the Philippines, responsible for overseeing the country’s financial stability, regulating financial institutions, and implementing policies essential for a secure banking environment. Here’s a quick overview of its core roles:

- Monitoring economic developments and facilitating sustainable growth.

- Promoting financial inclusion among Filipinos.

- Implementing regulatory frameworks to ensure safe transactions, particularly in the digital landscape.

The BSP’s directive focuses on establishing clear guidelines for Filipino e-wallet regulations, specifically to enhance user safety and promote responsible usage within the growing digital financial ecosystem. The primary objectives include:

- Defining standards for iGaming payment links to ensure transparency and security in online gaming transactions.

- Implementing the new BSP e-wallet rules to protect consumers and facilitate smooth operations for service providers.

- Encouraging innovation while maintaining a robust regulatory framework to safeguard users against risks like fraud and data breaches.

In summary, the BSP’s directive serves as a crucial step forward in regulating the rapidly evolving sectors of digital finance and gaming in the Philippines, promoting a secure environment for all stakeholders.

Understanding E-Wallets

E-wallets, or electronic wallets, are digital tools that allow users to store, send, and receive money electronically. They function as a virtual wallet, enabling seamless online transactions without the need for cash or cards. Here are some key features of e-wallets:

- Convenience: Easily make payments anytime, anywhere.

- Security: Enhanced protection with encryption and two-factor authentication.

- Speed: Instant transactions, eliminating waits associated with traditional banking methods.

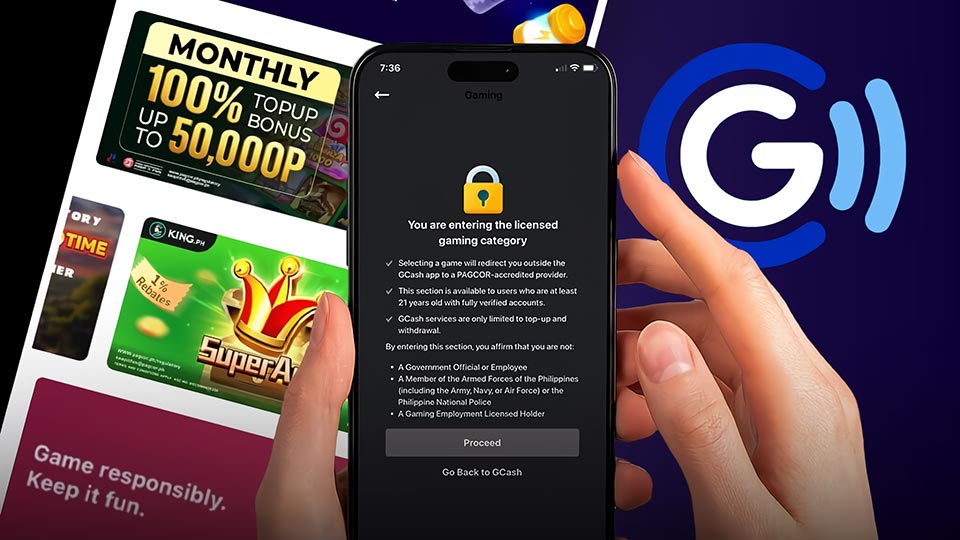

Role of E-Wallets in iGaming

E-wallets play a significant role in the iGaming industry by providing efficient and safe payment methods for players. With the rise of online gaming platforms, the demand for instant and reliable transaction options has grown immensely. In the Philippines, Filipino e-wallet regulations are crucial for ensuring compliance and security in online gambling. Here’s how e-wallets impact iGaming:

- Regulatory Compliance: They must adhere to BSP e-wallet rules, ensuring safe transactions.

- Payment Flexibility: Players can quickly deposit and withdraw funds using various iGaming payment links.

- Enhanced User Experience: Quick and easy access to funds enhances the gaming experience.

In summary, e-wallets provide a crucial link in the iGaming ecosystem, facilitating secure and efficient financial transactions governed by stringent Filipino e-wallet regulations.

Impact of the BSP Order

Immediate Effects on E-Wallet Services

Apacaff | With the introduction of the new Filipino e-wallet regulations by the Bangko Sentral ng Pilipinas (BSP), the landscape of digital financial transactions has significantly shifted. Key immediate effects include:

- Increased Compliance: E-wallet providers are now mandated to adhere strictly to BSP guidelines, ensuring enhanced security and customer protection.

- Transaction Transparency: All transactions must be documented, fostering a new level of accountability for both users and service providers.

- Access Limitations: Certain e-wallet functionalities may face restrictions, particularly in areas related to iGaming payment links.

Long-Term Implications for the iGaming Industry

The impact of the BSP’s regulation is not limited to immediate changes but extends to the long-term effects on the iGaming industry as well:

- Shift in Payment Options: As e-wallets navigate new regulations, other payment methods may gain traction, affecting how players transact.

- Regulatory Adaptation: iGaming platforms may need to adapt their services to comply with evolving regulations, potentially leading to an increase in operational costs.

- Market Growth or Decline: While tighter regulations can lead to enhanced safety, they may discourage new players from entering the market, impacting overall industry growth.

In conclusion, as the BSP e-wallet rules take full effect, both service providers and the iGaming sector must pivot and innovate to ensure compliance while fostering a secure environment for users.

Industry Reactions

Responses from E-Wallet Providers

In light of the recent updates to the Filipino e-wallet regulations, e-wallet providers have demonstrated a proactive stance. Many are enhancing their compliance measures to align with the new BSP e-wallet rules. Here are some notable reactions:

- Increased Transparency: Many e-wallet providers are promising clearer transaction processes for users.

- Enhanced Security: Providers are reinforcing security protocols to protect users’ funds and personal data.

- Customer Support Expansion: There’s a noticeable increase in customer support to assist users in navigating new regulations.

Feedback from iGaming Operators

iGaming operators have also weighed in on the changes regarding iGaming payment links. Their feedback reflects a mix of optimism and concern:

| Operator | Feedback |

|---|---|

| PhilGame Interactive | Expressed concerns about the challenges in adapting to the stringent e-wallet compliance requirements. |

| LuckyPlay Online | Highlighted the potential for increased trust among players due to more regulated payment processes. |

| NextLevel Gaming | Welcomed the updates as a means to improve overall industry standards and security. |

As these changes unfold, both e-wallet providers and iGaming operators are poised to adapt, ensuring compliance while fostering a secure environment for all users.

Legal and Regulatory Framework

Existing Regulations on iGaming

In the Philippines, the legal landscape surrounding iGaming is shaped by several key regulations aimed at ensuring a secure and fair gaming environment. The principal framework includes:

- Licensing mandates for operators to ensure compliance with local laws.

- Strict KYC (Know Your Customer) guidelines to prevent fraud and money laundering.

- Consumer protection measures that safeguard players from unethical practices.

Moreover, the Filipino e-wallet regulations play a pivotal role in iGaming, offering diverse payment solutions that cater to players’ needs. With the rise of iGaming payment links, the integration of e-wallets has never been more critical.

Analysis of BSP’s Authority

The Bangko Sentral ng Pilipinas (BSP) holds significant influence over iGaming operations, particularly concerning financial transactions:

- BSP formulates e-wallet rules that govern digital payment platforms used in gaming.

- Regulations enforce compliance and security standards, fostering trust in e-wallet services.

- The BSP continuously monitors the evolving landscape to adapt its policies accordingly.

Overall, the establishment of these regulations is crucial in maintaining a balance between innovation in the gaming industry and the need for regulatory oversight. As the iGaming sector grows, so do the responsibilities of regulatory bodies like the BSP to ensure both player safety and fair play.

Trends in the E-Wallet Market

Growth of E-Wallet Usage

The rise of digital wallets has revolutionized the way Filipinos conduct transactions. The popularity of e-wallets can be attributed to several factors:

- Accessibility: E-wallets are easily accessible via smartphones, promoting convenience for everyday purchases.

- Speed: Transactions happen almost instantly, reducing waiting times compared to traditional banking methods.

- Variety: Users can store multiple payment options in a single app, streamlining their financial management.

- Security: Enhanced measures make transactions safer, boosting user confidence in digital payments.

Future Trends Post-BSP Order

With the recent implementation of Filipino e-wallet regulations by the Bangko Sentral ng Pilipinas (BSP), the landscape of digital payments is set for significant transformation. Here are a few anticipated trends:

“The BSP e-wallet rules are expected to pave the way for more innovations in payment systems, particularly in the iGaming sector.”

- Enhanced Compliance: E-wallet providers will need to align with regulatory standards, promoting trust and accountability.

- Increased Integration: Expect more partnerships between e-wallets and iGaming platforms, facilitating seamless transactions for users.

- Advanced Security Features: As regulations tighten, e-wallets will adopt cutting-edge technology to ensure safer transactions.

In conclusion, the future of e-wallets looks promising, especially as Filipino e-wallet regulations evolve to harmonize with user demands and technological advancements. Stay tuned for more updates as this exciting market develops!

Best Practices for Compliance

Strategies for E-Wallet Providers

To ensure adherence to Filipino e-wallet regulations, providers should consider the following strategies:

- Conduct Regular Audits: Frequent compliance checks help in identifying potential gaps.

- Employee Training: Keep your staff updated on the latest BSP e-wallet rules and regulations.

- Robust Security Measures: Implement stringent security protocols to protect user data and financial transactions.

- Transparent Communication: Ensure clarity about fees, transaction processes, and compliance standards.

Guidelines for iGaming Companies

For iGaming companies, integrating iGaming payment links must align with regulatory requirements. Here are some essential guidelines:

✅ Secure Payment Processing: Utilize only trusted payment gateways to minimize fraud.

💡 User Verification: Implement KYC (Know Your Customer) policies to authenticate players effectively.

| Compliance Aspect | Best Practice |

|---|---|

| Licensing | Ensure all gaming operations are fully licensed according to local laws. |

| Data Protection | Adopt the latest data protection technologies to safeguard user information. |

By following these guidelines, both e-wallet providers and iGaming companies can navigate the complexities of compliance while maintaining user trust and operational integrity.

Conclusion

Summary of Key Points

In wrapping up our discussion, it’s essential to highlight the major takeaways regarding Filipino e-wallet regulations and their impact:

- Regulatory frameworks by the BSP ensure security and transparency in digital transactions.

- iGaming payment links are subject to stringent checks to safeguard users and operators alike.

- Understanding the BSP e-wallet rules is crucial for businesses aiming to operate within the Philippines’ vibrant e-commerce landscape.

Future Outlook

Looking ahead, the landscape of e-wallets in the Philippines is poised for significant transformation:

- As the digital economy expands, expect evolving Filipino e-wallet regulations to adapt and respond to new technologies and market demands.

- The increase in online gaming popularity suggests that iGaming payment links will become more diversified, providing greater flexibility for consumers.

- Increased compliance will likely drive the development of more user-friendly interfaces, making it easier for users to understand the BSP e-wallet rules and procedures.

Overall, staying informed about these developments will be vital for both consumers and businesses to navigate the future of digital finance successfully.

Frequently Asked Questions (FAQs)

What does this directive mean for players?

With the latest Filipino e-wallet regulations set forth by the Bangko Sentral ng Pilipinas (BSP), players engaging in iGaming may experience some notable changes. Here’s how it impacts them:

- Enhanced Security: Player safety is a priority, and these regulations aim to ensure that your transactions are well-protected.

- Streamlined Transactions: Expect quicker and smoother payment processing, making deposits and withdrawals more efficient.

- Compliance Requirements: Players may need to comply with additional verification steps when using certain e-wallets for iGaming.

Are there alternatives to affected E-Wallets?

Yes, players can explore several alternatives to the e-wallets impacted by the new BSP e-wallet rules. Consider these options:

- Bank Transfers: Direct bank transfers provide a traditional method for funding your gaming account.

- Cryptocurrency: Digital currencies are gaining popularity as a secure and fast alternative to conventional payment methods.

- Other E-Wallets: Look for compliant e-wallets not affected by recent regulations, ensuring uninterrupted access to iGaming. Examples include popular services that have adhered to BSP guidelines.

By staying informed about these iGaming payment links and exploring your options, you can continue to enjoy gaming experiences without disruption.